1.Know Your Obligations

Understand who must be enrolled, contribution rates, and deadlines to ensure compliance. Refer to the government website for more information on Auto-enrolment. There are also plenty of free webinars on offer from pension and HR providers.

2. Decide on your Planned Approach

Employers need to decide if they wish to encourage enrolment in to their current pension arrangement (a single scheme approach) or if they will operate a dual scheme approach with some employees in the AE system and others in a company pension scheme.

3. Review your Payroll Data

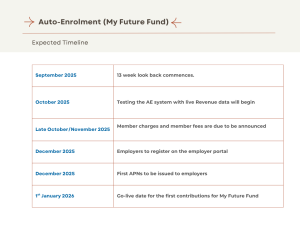

NAERSA who administer the AE scheme announced that it plans to issue the first AE Payroll Notifications (AEPN9) in early December based on payroll data collected from the Revenue. They will use a look-back period of 13 weeks across September, October and November to determine who is eligible. It is important that employee records are accurate.

4. Engage with Payroll Providers

Engagement with payroll software providers and the Revenue is currently ongoing. Employers need to confirm with their payroll providers that their system is compatible and ready to support AE.

5. Employer Portal Launch

This is expected to launch in early December. When launched employers will be asked to register on the portal with their company details and payment details for contributions.

6. Review Existing Schemes

Check current pension plans and see which employees auto enrolment rules apply to and update employment contracts if needed.

If needed, seek advice from a Financial Adviser who can provide tailored guidance for your business.