As we say Farewell to 2025, here are my top year end resolutions for Business Owners! Some may be actioned before year-end:)

1. Make sure you have a Will in place.

2. Utilise the annual Small Gift Exemption of €3,000.

3. Many companies have 31st December year ends – pay company contribution before year end.

4. Don’t run out of road with time limits (4 year rule – 2021 before 31st December 2025).

5. Utilise the Small Benefit Exemption of €1,500 (e.g. gift vouchers!).

6. Crystallise any capital losses, CGT losses cannot be carried back to prior tax years but may be offset against gains in 2025 and may be carried forward

7. Plan ahead for a business sale or transition in the future now.

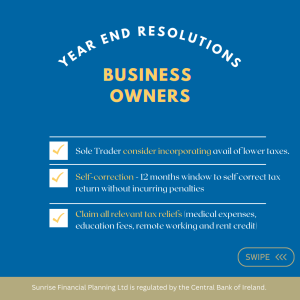

8. Sole trader – consider incorporating to avail of lower corporation tax rates.

9. Claim all relevant tax reliefs (medical expenses, education fees, remote working relief, rent credit)

10. Self-correction: 12 months window to self-correct a tax return without incurring a penalty

#businessowners #financialplanning #wealthmanagement